Advisory Services

Financial crime prevention (FCP) is business-critical, from both an operational and reputational standpoint. Our range of services help you to strengthen your defenses from the ground up, supporting you wherever you are in your FCP journey.

why choose us

Benefits of Avallone Advisory Services

Expertise

Benefit from deep KYC and financial crime prevention expertise without hiring internally. Avoid payroll, employment responsibilities, and other associated risks.

Objective

Expert and neutral advice from a third party, informed by up-to-date knowledge of the compliance and regulatory landscape.

Senior Experience

Think of us as your Fractional Chief Compliance Officer. High-level, strategic experts with broad experience across a range of industries.

Responsive

KYC and compliance matters can be time-critical. Our experts are always on hand, available when you need them most.

Set the right foundation for your compliance program

Strategic support from seasoned compliance professionals

Avallone’s Advisory Services provide experienced, hands-on support to help organizations strengthen their KYC and financial crime prevention frameworks. Our team works closely with yours to design practical solutions that are aligned with your operational reality, regulatory obligations and internal priorities.

Whether you're building a KYC program from scratch, updating existing processes, getting ready for an audit, or preparing for a new phase of activity, we bring a depth of expertise that allows you to move forward with confidence. Our specialists assist with the development and documentation of internal policies and procedures, offer guidance on how to structure risk scoring models, and help clarify roles and responsibilities within your team.

We also support internal alignment by joining meetings, answering stakeholders’ questions, and ensuring that everyone involved understands the rationale behind your approach. Our role is to complement your team’s capabilities with clear, reliable advice that fits the way you work.

This type of support is particularly valuable when organizations are expanding into new areas, adjusting to growing regulatory expectations or simply looking to ensure that their compliance practices are robust and future-ready. Rather than offering generic templates or one-off suggestions, we work alongside you to create tools and processes that are practical, defensible and sustainable.

Avallone’s Advisory Services are grounded in real-world experience, and we aim to provide clarity and structure where it’s most needed. We’re here to help you establish a strong foundation for your KYC work - one that enables your team to operate effectively today and adapt with ease tomorrow.

Avallone is transforming KYC

Spreadsheets vs. Avallone

Struggling using spreadsheets to manage KYC? Boost your accuracy, productivity and data security with Avallone’s all-in-one KYC solution.

Financial Crime Prevention Framework

Whatever your KYC challenge, our services are designed to support you with exactly what you need, right when you need it. KYC experts “on tap”; no time and budget wasted.

Compliance takes deep expertise, significant resources, and sustained attention to detail – in short, hours out of your team’s daily schedule. While KYC tasks show no signs of slowing down, and as KYC experts are hard to find, Avallone’s Services offer an efficient solution to take care of the heavy lifting.

Whether you need help handling routine screening alerts, executing outreach campaigns, or managing a full KYC remediation, our services are designed to scale with you - compliantly and efficiently.

Risk Assessment

Whether a regulatory requirement or an internal objective, carrying out a risk assessment is the first step in lowering your exposure to risk. Call in Avallone’s Advisory Services to facilitate workshops with the relevant teams, pull together available risk-related data, and deliver a comprehensive risk assessment.

You know your business best, so Avallone’s expert team always ensures that all outputs are tailored specifically to your business, existing controls and risk appetite.

Financial Crime Prevention Training / Implementation

Financial crime prevention (FCP) policies and procedures are only effective when they’re actively put into practice by confident and knowledgeable team members.

Whether training is a legal requirement for your organization, or you’re sensibly looking to ensure that your policies and procedures are followed to effectively mitigate risk, Avallone’s training experts are on hand to offer support. Avallone’s Advisory Services team specializes in not only designing and developing FCP guidelines, but also in supporting staff with the skills to put them into action.

Need help to implement new or existing frameworks, policies or procedures? With 30+ years of delivering projects to fight financial crime, our team can also step in to implement FCP projects effectively.

High Risk & Critical Incident Support

Despite best efforts, many organizations can unexpectedly find themselves in a high-pressure, high-risk situation. Facing the consequences of potentially illegal activities, such as financial penalties, legal consequences, regulatory investigations and damage to reputation and stakeholder trust, it can be difficult to work out what immediate action needs to be taken. Navigating complex compliance issues while also handling an emergency response can feel overwhelming and isolating.

Our Advisory Services team has extensive crisis experience and can provide clarity on the extent of the risk, a plan to reduce further risk, and support to manage the practical response and regain control of the situation. Avallone’s Advisory Services team also supports with communication with regulators and stakeholders, and can advise on strengthening controls to prevent future incidents.

SOLUTIONS TO MEET YOUR KYC NEEDS

Challenges solved by Advisory Services

challenge #1

Securing high-level support from senior compliance experts

It’s hard to find senior expertise in the field of banking, compliance and KYC / CDD. The long-term commitments and costs associated with permanent hires also means that in-house recruitment is not a preferred option for many organizations.

Additionally, support may only required for one-off foundational work, or for a defined period of time.

The result

Expert support from team with 50+ years of compliance and risk experience

Easy access to broad expertise with extensive industry experience. Services are available when needed, and are adapted to suit each organization.

Meaning that:

- High-level guidance is available when required, for the specific duration or scope of each project, without long-term commitments or costs associated with permanent hires.

- Organizations get access to expert and neutral advice, informed by up-to-date knowledge of the compliance and regulatory landscape.

- Dedicated, specialized focus on specific compliance work ensures that projects are delivered on time, without the need to juggle multiple internal priorities.

challenge #2

Need to meet specific regulatory requirements

Organizations can be suddenly required to meet new requirements - whether due to expansion into new markets or jurisdictions, internal changes, increased scrutiny or enforcement, or updates in regulations.Without expert guidance on hand, it can be difficult and stressful to navigate this complex environment, and ensure that every area is managed effectively and on time.

The result

With expert guidance, all your boxes are checked

With up-to-date knowledge of the regulatory landscape, Avallone’s Advisory Services team acts as a trusted partner offering guided support throughout this process.

Meaning that:

- Organizations get expert support to navigate complex regulatory changes confidently.

- Seeking external support ensures that business continuity is maintained throughout the process, and that important deadlines are met.

- Organizations, regulators and key stakeholders are reassured that regulatory complexities are handled effectively, and that financial and reputational risk is proactively mitigated.

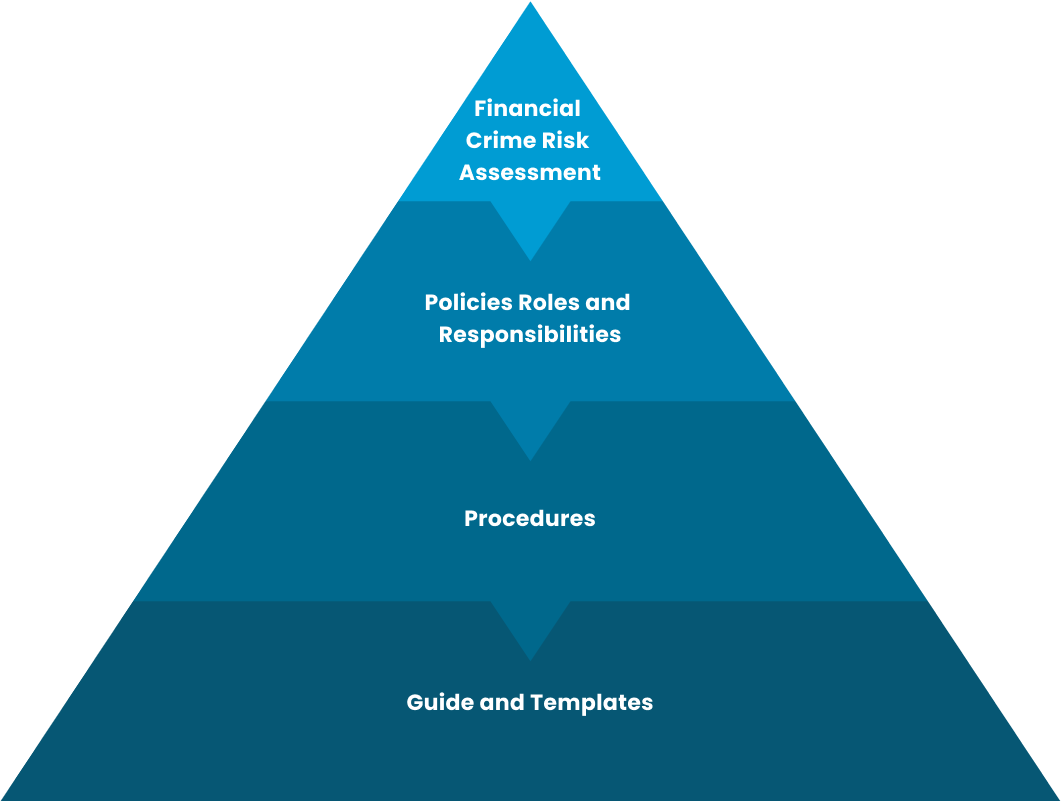

How we work: Our Financial Crime Prevention Framework

Our holistic methodology for aligning your KYC, AML and Sanctions work

The Financial Crime Prevention (FCP) Framework is Avallone’s unique way of empowering Advisory Services clients with a structured, risk-based approach to combat money laundering, fraud, bribery, corruption and sanctions violations.

Tailored to each organization’s specific set-up and needs, the framework is developed using a combination of information gathered through workshops and conversations with internal teams, as well as existing policies and procedures.

It includes a complete FCP Risk Assessment, and clearly defined Roles and Responsibilities. We also support the development and integration of your internal policies: from prohibited transactions to global safeguarding and treasury risk escalation - ensuring consistency across jurisdictions and departments.

With supporting procedures, guides, and templates built directly into the Avallone platform, your team is empowered to confidently respond to KYC requests, maintain data accuracy and escalate concerns effectively.

NEED TO KNOW

Frequently Asked

Questions

DESIGNED WITH YOUR needs IN MIND

The KYC solution for your industry

Enterprise Corporates

Streamline your KYC workflows to handle complex cases with ease, and save teams time. All officer and UBO information stored in one secure location.

Funds

Simplify KYC with customizable templates and easy investor ID checks. Ensure compliance and audit-ready transparency by centralizing KYC comms.

Banking and Finance

Unlock unparalleled speed and accuracy in KYC, for you and your customers. Gain time and deliver a smooth experience, while meeting AML and CFT requirements.

Legal Services

Work with speed and agility in your team and across the business. Auto-generate Legal entity structure charts and UBO visualizations including voting rights.

See the Avallone Platform in Action!

%20(1).jpg)

ONLY AFTER 1 YEAR

What’s the ROI?

Avallone customers see improvement and savings across their KYC processes and response times. Imagine what your ROI could be!

Save the Children loves Avallone's KYC solutions

TRUSTED BY INDUSTRY LEADERS

Our banks have recognized that we’re aiming to be ahead of the curve by adopting innovative KYC solutions. One banking partner even commented that Avallone’s solution is ‘game changing’. Overall, our banking partners are reassured that we’re working with Avallone - a dedicated KYC partner on improving our KYC processes - and proactively sharing risk-related information. I think this has had a direct impact on reducing the number of delayed payments.

— Edward Collis, Treasurer

We really appreciate the insights we see within Avallone’s KYC Collector tool - it has found things that we would never have otherwise uncovered. Our banks also appreciate that we have this extra layer of risk mitigation in place

— Asha Kumari, Deputy Treasurer, Save The Children International

I found the KYC Responder so easy to use and navigate - it’s an excellent one-stop-shop for us. It made getting visibility on data and documents we need to share with banks so simple.”

— Saira Maniar, Senior Treasury Compliance and Crisis Funding Manager, Save The Children International

The Full kyc suite

Level up your KYC with Avallone's Services

Take your KYC to the next level with Avallone's Services. Gain access to deep KYC expertise, tried and trusted processes, and dedicated support sized to meet your current and future needs. Let us lighten your workload, and drive better results.

.svg)

Managed Services

Hands-on support to relieve your KYC / CDD workload. Our experts work alongside your team to provide scalable support where and when you need it most.

.svg)

Advisory Services

Trust our expert team with +30 years of financial crime prevention and compliance experience to help define processes, develop frameworks and tackle complex KYC challenges.

.svg)

Outreach Services

Designed for banks and financial institutions looking to simplify their KYC document collection. Let us take care of the time-consuming communication and follow-up, and elevate the experience for your customers.

Remediation Services

For regulated companies seeking proactive solutions to meet their compliance deadlines. Tap into remediation support to refresh and verify customer profiles quickly and accurately.

STAY UPDATED WITH KYC TRENDS

Related Articles

Why KYC is Essential: Combating the Underlying Crimes in Financial Systems

From money laundering to terrorism financing, KYC processes are designed to verify the identities of clients and understand the nature of the business relationship.

KYC Is No Longer Just for Regulated Companies

KYC is now essential for all businesses, not just regulated ones. See how sanctions, reputational risk and screening make KYC critical for protecting your brand.

Third-Party Risk Management vs. KYC: What's the difference?

Understand the difference between third-party risk management (TPRM) and Know Your Customer (KYC) processes, and why the two areas are increasingly connected.

Why is creating a financial crime risk assessment so painful?

Overcome this hurdle, because a good financial crime risk assessment will give you a better insight into your business and processes...

.svg)

.svg)

.png)

.png)

.png)

.png)