KYC Collector

Streamline KYC collection from customers, suppliers, investors or partners by centralizing the entire process, tracking every request, and screening and monitoring counterparties with the click of a button. Say goodbye to KYC chaos - and hello to full compliance.

SOLUTIONS TO MEET YOUR KYC NEEDS

Solve all your challenges with KYC collection

challenge #1

Disconnected processes and systems

Difficult to manage requests using a scattershot mix of email, spreadsheets and shared drives. As a result, there are delays, missing documents and poor visibility of the end-to-end process.

Data and documents are collected in fragmented tools, and none of the information is centralized.

Counterparties are left with a negative impression.

The AVALLONE SOLUTION

KYC processes, data and documents centralized for full visibility

Data and documents are stored and secured in one place and there’s easy visibility on the progress of all requests.

Meaning that:

- No more searching for information in emails, attachments or shared drives. Everything is right where it needs to be, and can be re-used to save time.

- Everyone stays up-to-date on the progress of a request, and they are empowered to follow up on any outstanding actions.

- Counterparties love the user-friendly collection tool: it streamlines the process and saves them time. Collection requests are therefore processed much more quickly.

challenge #2

Inconsistent risk scoring and processes across counterparties

No consistency in workflows, meaning that important processes - such as screening and risk scoring - can vary from case to case. As a result, conclusions are inconsistent, leading to potentially greater risk exposure.

The AVALLONE SOLUTION

Improved processes and better outcomes

A standardized, data-driven approach to risk assessment - with built-in, multi-layered risk scoring to create accurate conclusions.

Meaning that:

- Processes are easy to follow in the KYC Collector, ensuring consistent decision-making.

- Tailor-made approval flows ensure that high risk cases are managed appropriately - and by the right people in the organization.

- There’s an easy overview of actions, decisions made, along with supporting information - and this data can be exported whenever required.

- Exposure to risk is significantly reduced.

See the KYC Collector in Action!

%20(1).jpg)

USERS’ FAVORITES

Popular KYC Collector Features

Centralized KYC request dashboard

Get an easy overview of your risk distribution and screening monitoring, as well as any tasks or requests in progress. Automatic notifications will alert you to expiring documents, ensuring that nothing is missed.

- All data for every counterparty - together in one place for manageable oversight.

- Follow the progress of every counterparty from start to finish.

- Easy dashboard and data export.

Flexible questionnaire models

Need information or documents from a counterparty? Send a pre-designed questionnaire in a couple of clicks to save time and ensure consistency. Prefer to build your own? It only takes a few easy steps using our flexible and user-friendly modules.

- Send questionnaires directly from the KYC Collector for full visibility and added security, with the option to personalize messages to the counterparty.

- Specify the data and documents needed, and add a due date to ensure nothing falls through the cracks.

- Collaborate with colleagues, and keep everyone in the loop.

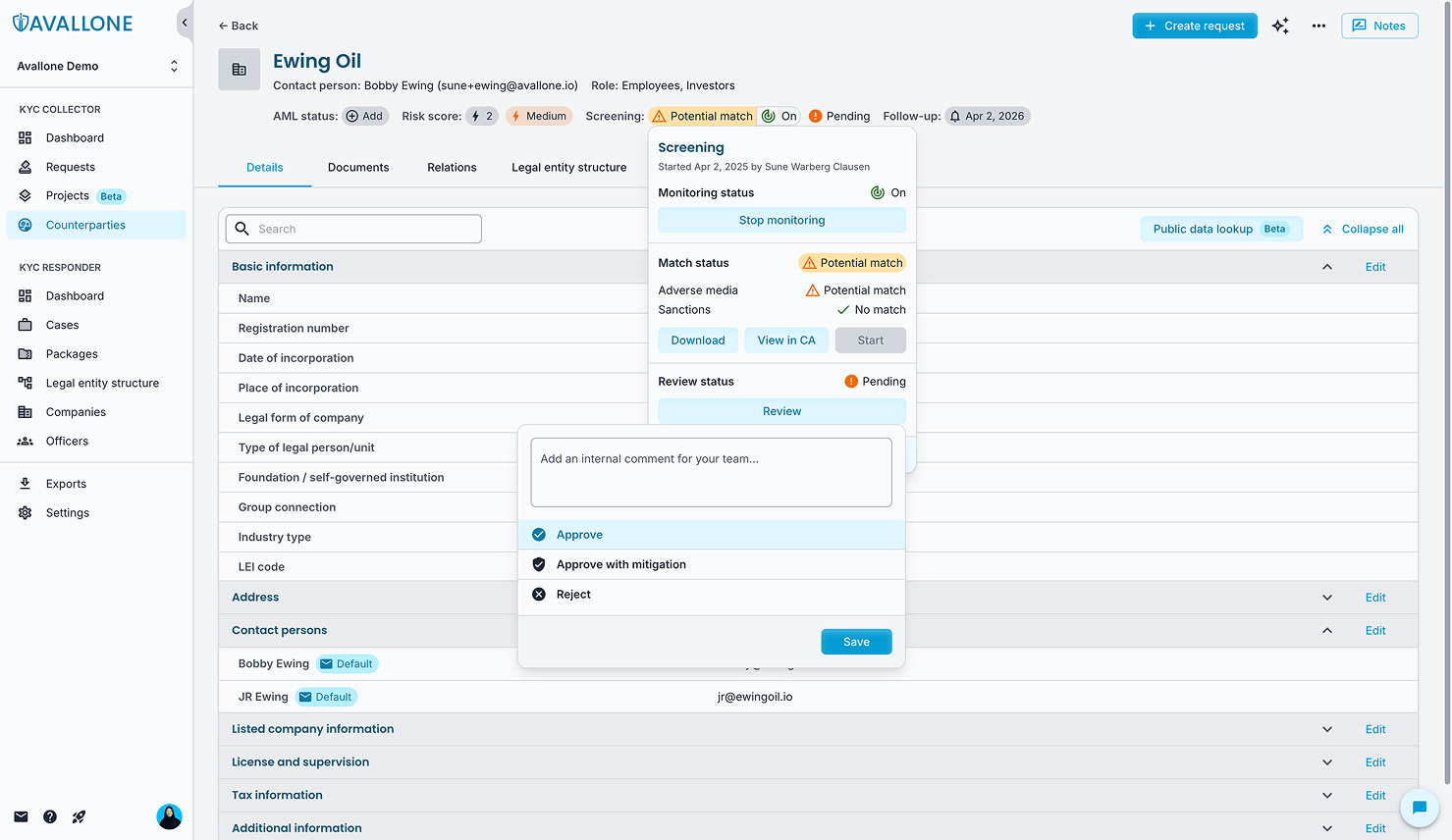

Real-time screening and ongoing monitoring

Screening for adverse media, PEPs and Sanctions is a crucial part of the KYC process, so the KYC Collector has built-in 24/7 screening and monitoring for all counterparties and UBOs.

- Avallone works with ComplyAdvantage, the leading provider of banking-grade screening capabilities, ensuring that data is always up-to-date and of the highest quality. The two platforms are integrated seamlessly, requiring no manual moving of data.

- Screening automatically starts as soon as counterparties and UBOs are entered into the platform, giving our users an early start on this vital process.

- Easily download screening data into helpful reports.

Integrated risk scoring and risk assessment

The KYC Collector helps you to apply a standardized, data-driven approach to risk assessment, with built-in, multi-layered risk scoring to create accurate conclusions.

- Options to manually assign risk factors (e.g. adverse media or sanctions), approve or reject risk scores, add explanations for extra context and documents to support your case.

- Set up customizable approval flows if required.

- Download risk-related data into reports for full audit trails.

Unlimited collaboration

KYC requires teamwork, so we don’t charge extra for more users. Assign tasks, invite colleagues to upload documents, and keep all parties updated on your KYC work.

User friendly UI

Avallone’s user-friendly interface ensures every KYC form you send looks polished, clear and easy to complete. A clean design that builds trust and speeds up replies.

GDPR compliance

A secure, compliant way of storing, maintaining and sharing data. Reassure your stakeholders that their sensitive data is respected at all times, and protect your reputation.

Audit-ready records

Automatic capture of actions made for collection, screening, and risk scoring activities. Download reports at any time, whenever you need them for an audit.

TRIED AND TESTED

Customers’ results after 1 year:

Avallone customers see improvement across their KYC processes and response times.

What could your ROI be?

Urban Partners Loves the Avallone Platform

TRUSTED BY INDUSTRY LEADERS

Even though many of our people hate KYC - they love using Avallone.

The KYC Collector has made collecting KYC so much easier for us. Everything is in one database, so it’s easy to see if we already hold information on a specific person - and we can have the same person attached to several legal entities. The platform is also really intuitive, so everything takes less time than it did before.

If it hadn’t been for Avallone, we would have needed to add to our headcount in some way, which wouldn’t have been cost-efficient for us. Avallone therefore helps us to reach our organizational goal to optimize resources as much as possible.

— Mathias Sachse Skrubbeltrang, Senior Legal Counsel, Urban Partners

HOW AVALLONE SUPPORTS

We're here to help

Whether you’re facing a technical issue or have general KYC enquiry, Avallone’s friendly team of in-house KYC experts are always on hand to guide you.

Knowledge Base

Access product overviews, helpful tips and tricks, and step-by-step instructions written by our expert team. All resources are fully up-to-date and easy to navigate.

Customer Support

Our experienced support team is here to assist with any issues or queries you may have. Drop us a message, or chat with us live, and we’ll always go the extra mile to get you the answers you need.

API Integrations

Our API is open and ready to hook into any of your existing databases. We’re passionate about enabling interconnection between systems – powering efficient workflows and up-to-date real-time KYC information.

NEED TO KNOW

Frequently Asked

Questions

What is KYC compliance?

KYC compliance is a structured approach to managing the risks associated with verifying and onboarding customers, counterparties or other entities. It involves implementing a centralized platform to automate due diligence, conduct risk assessments and ensure that data collection and identity verification processes meet regulatory requirements and internal policies.

What is customer due diligence (CDD)?

Customer due diligence (CDD) is the process of collecting and evaluating information about a customer or counterparty to assess the risk they may pose. It includes verifying identities, understanding beneficial ownership structures and reviewing relevant documentation to meet compliance obligations and reduce exposure to financial crime, fraud or reputational damage.

What is a KYC solution?

A KYC solution is a dedicated software platform designed to help organizations manage and streamline customer due diligence and regulatory compliance. These platforms typically offer features like automated document collection, identity verification, risk scoring, centralized data storage and audit trails, making it easier to ensure ongoing compliance with AML regulations and internal governance standards.

How do you manage KYC effectively?

Managing KYC effectively requires a combination of automation, oversight and secure data handling. With a configurable KYC platform, organizations can tailor workflows to different entity types, track compliance status across teams, and adapt quickly to changing regulatory requirements. This improves efficiency, enhances risk visibility and helps teams stay audit-ready at all times.

DESIGNED FOR CURRENT AND FUTURE NEEDS

Scale up with your KYC software

We know that your KYC needs may change with time, so you always have the flexibility to scale up or back as required. Start with the products you need right now, and level up as your needs evolve - ensuring seamless and scalable growth.

The Full kyc suite

Powerful on its own, but even better when together

Each product in the Avallone platform is connected to the same underlying KYC database.

While our KYC Collector is an incredible tool on its own, you can unlock game-changing efficiencies and next-level KYC management when it’s used alongside our other products and services.

KYC Responder

Say goodbye to manual handling of incoming KYC requests. Easily save, store and re-use responses to avoid endless duplication.

KYC Hub

One single source of truth for managing and visualizing legal entity structures and documents across your entire organization.

.svg)

Advisory Services

Trust our expert team with +30 years of financial crime prevention and compliance experience to help define processes, develop frameworks and tackle complex KYC challenges.

.svg)

Managed Services

Hands-on support to relieve your KYC / CDD workload. Our experts work alongside your team to provide scalable support where and when you need it most.

STAY UPDATED WITH KYC TRENDS

Related Webinars

KYC in the Era of Global Sanctions

Effective KYC and Sanctions Management for the Future

Crowdfunding for Terrorism Financing

.svg)

.svg)

.png)

.png)

.png)

.png)