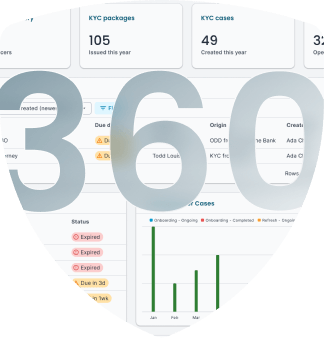

Answer KYC requests with ease

One place to store, structure and share KYC info with banks and counterparties.

Streamlined, secure KYC collection

Collect from counterparties with zero friction.

.svg)

24/7 screening to stay ahead

Real-time monitoring for sanctions, PEPs, adverse media and more.

.svg)

Entity management and diagrams

Single source of truth for the entire organization, generating corporate / UBO structures and more.

.svg)

Built-in AI capabilities

Integrated AI takes care of repetitive KYC tasks, freeing your team to focus on high-value work.

.svg)

Managed Services

Whether you're responding to Bank KYC or collecting KYC, this is hands-on, scalable support to ease your KYC / CDD workload.

We empower smart teams to RUN KYC

Your competitive edge to compliance

Streamline KYC, due diligence, and more - all in a single platform

testimonials

Don’t take our word for it

See first-hand how our customers manage KYC with ease

Cost-efficient KYC one stop shop for Urban Partners

Even though many of our people hate KYC, they love using Avallone.

Everything related to KYC is in one single place. We love that Avallone is a 1 stop shop for all things KYC.

If it hadn’t been for Avallone, we’d have needed to add to headcount in some way, which wouldn’t have been cost-efficient for us. Avallone therefore helps us to reach our organizational goal to optimize resources. Avallone has shown that we can save a lot of time, and do KYC even better than before.

— Mathias Sachse Skrubbeltrang, Senior Legal Counsel, Urban Partners

Saving Novo Holdings more than 300h / year!

Avallone is a very fast system, and so intuitive. We used to spend 40 minutes on a typical KYC request, whereas now it can take as little as ten minutes. This means that we’ve gained around three working days per month, which equates to more than 300 hours per year!

We went from a totally analog setup where we had no oversight of our KYC work, to a full overview and audit trail available at any time with Avallone.

— Mia Bøttzauw-Jørgensen, Head of Investment Operations, Novo Holdings

A KYC "game changer" for Save the Children International

Our banks have recognized that we’re aiming to be ahead of the curve by adopting innovative KYC solutions. One banking partner even commented that Avallone’s solution is ‘game changing’.

Overall, our banking partners are reassured that we’re working with Avallone - a dedicated KYC partner on improving our KYC processes - and proactively sharing risk-related information. I think this has had a direct impact on reducing the number of delayed payments.

— Edward Collis, Treasurer, Save the Children International

Avallone is transforming KYC

Spreadsheets vs. Avallone

Struggling using spreadsheets to manage KYC? Boost your accuracy, productivity and data security with Avallone’s all-in-one KYC solution.

Spreadsheets

Primitive, time-consuming workflows and outdated, unsecured data.

- Manual - no AI capabilities

- Error-prone

- Siloed data

- Unsecure

- Not up-to-date

- No screening

- Primitive visualization and reporting

- Clunky workflows

With

.svg)

Automation

Powered by automation for enhanced and accelerated workflows.

- Automated, AI-powered workflows

- Always accurate with real-time updates

- Data stored and maintained in one place

- Fully secure and GDPR compliant

- Always up-to-date with latest data available 24/7

- Built-in screening and risk assessment

- Intuitive data visualization, easy reporting

- Smooth collaboration, seamless workflows

Avallone is transforming KYC

Manual Work vs. Avallone Automation

Forrester data shows that “80% of compliance departments are looking to automate some of their activities in the next three years”. Transform your processes today to stay ahead and save time.

Manual processes and legacy tools

Cumbersome, repetitive processes with high error risk and limited scalability.

- Repetitive data entry

- Inconsistent follow-ups across teams

- Delayed turnaround on KYC responses

- No centralized case management

- Difficult to scale across entities or jurisdictions

- High dependency on individual team members

- Lack of real-time visibility into KYC status

- No audit trail for accountability

With

.svg)

Automation and AI

Engineered to streamline complex KYC tasks with precision, speed and control.

- One-click KYC package generation

- Automated AI-powered task routing and follow-up reminders

- 24/7 visibility into request status and ownership

- Centralized case management and version control

- Scalable processes for global compliance teams

- Knowledge accessible throughout the platform, not just people and inboxes

- Instant insight into bottlenecks and completion rates

- Built-in audit trail with time-stamped actions

DESIGNED WITH YOUR INDUSTRY IN MIND

KYC Solutions tailored to your needs

Whatever your industry or team, our tailored solutions are built to meet your specific needs. Our KYC

products are also flexible and able to grow with your business and evolving requirements.

By Industry

Enterprise Corporates

Funds

Banking and Finance

Legal Services

By Role

Treasury

.png)

Legal

Compliance

Procurement

By Requirements

- AML, KYC and CTF

- Remediation for AML / KYC

- Sanctions

- High Risk / Dual-Use Corporates

- ESG

By Requirements

- Counterparty Onboarding

- Know Your Customer KYC

- Customer Due Diligence CDD

- Third Party Risk Management TPRM

- Screening: Sanctions, PEP, Adverse Media

- Ongoing Due Diligence ODD / KYC Refresh

benefits

Why choose Avallone?

Centralized data and document management

Easily store, maintain and access KYC-related information in one single, secure location. Eliminate silos, bottlenecks and version confusion..

Streamlined, AI-powered workflows

Remove repetitive tasks, reduce manual data entry, and accelerate response times. Deliver an elevated experience for internal teams, customers and stakeholders.

Transparent KYC communication and collaboration

Task assignment and tracking tools allow teams to work together in real-time, exchange comments, and monitor progress - all within one platform.

Total security and compliance

Enterprise-grade security, robust authentication controls and secure document sharing. Full compliance with GDPR, AML, CFT and other requirements.

Expert KYC partners on hand

Tap into 30+ years of experience in banking, compliance and KYC processes. Our expert team offers guidance, best practices, and practical support whenever you need it.

Easy onboarding and user experience

Our intuitive platform is easy to onboard, and designed for both technical and non-technical users. Integrate Avallone into your existing workflows in record time.

fully secure and compliant

Proud to be SOC ll Certified

Data security and regulatory compliance are of the utmost importance to us. Rest assured that we’re SOC II certified, meaning that we always meet the highest standards of compliance, data security and management.

.png)

.png)

INVESTED IN FLEXIBLE TECHNOLOGY

Open APIs for easy integration

Our API is open and ready to hook into any of your existing databases. We believe that the future of KYC will rely on interconnection between systems – powering efficient workflows and up-to-date real-time KYC information.

.png)

STAY UPDATED WITH KYC TRENDS

Recent KYC Insights

What’s Broken in KYC and AML? Fixes in 2026 for Compliance Teams

Speed is the defining 2026 challenge for KYC and AML so compliance teams must fix static review cycles, address AI-driven fraud and prepare for AMLA regulations.

2026 Predictions for the future of AML and KYC compliance

The Avallone team shares the top trends shaping compliance this year - from AI and perpetual KYC to increasing regulatory pressures

AI in KYC: The five key questions senior leaders should be asking

Five key points for leaders considering AI in KYC to discuss with their teams

.svg)

.png)

.png)

.png)

.png)