KYC COLLECTOR FEATURE

Real-time screening and ongoing monitoring

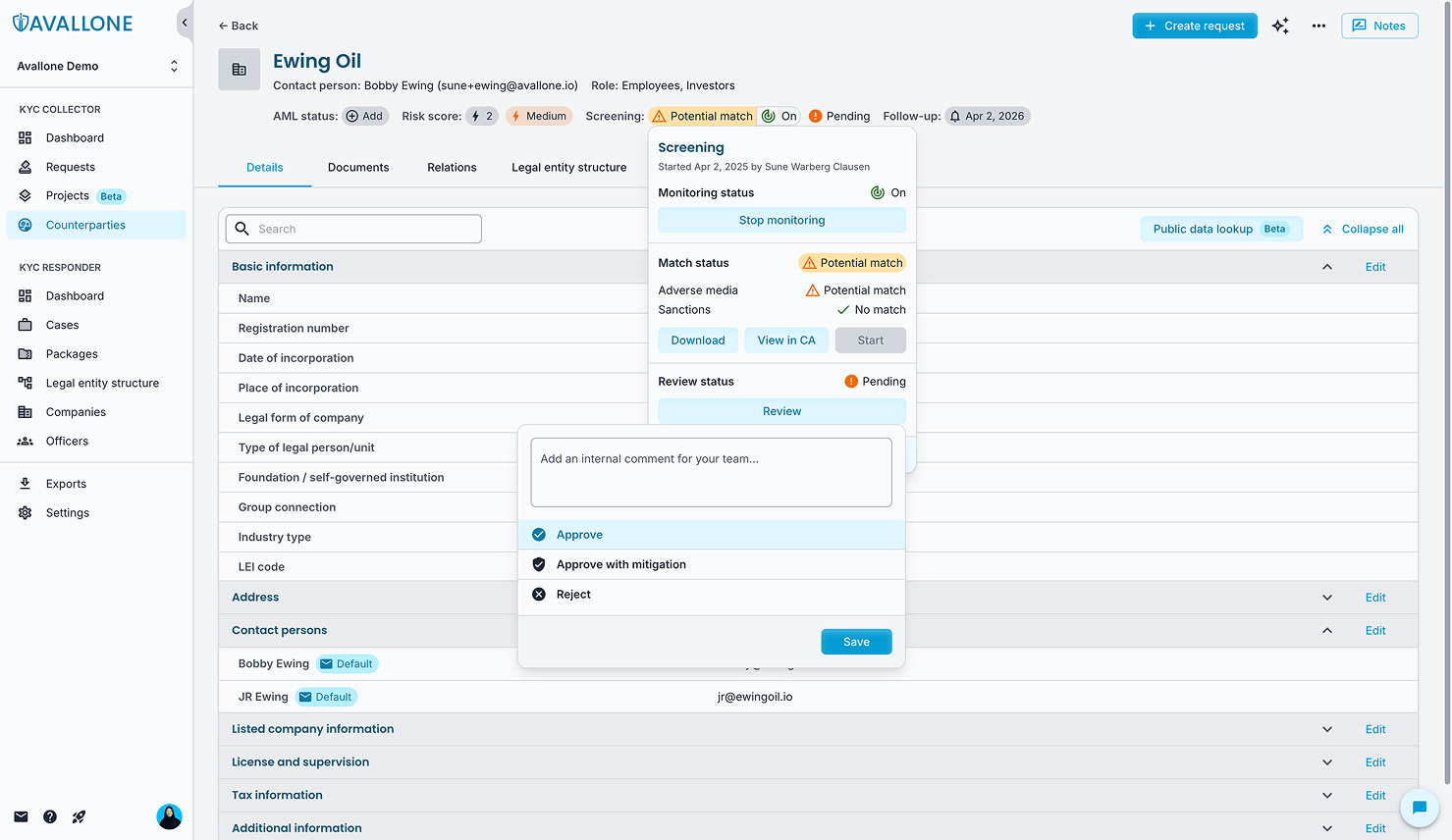

Screening for politically exposed persons (PEPs), sanctions, and adverse media is one of the most critical steps in the KYC process. To make this seamless, the Avallone KYC Collector includes built-in, always-on screening and ongoing monitoring for every counterparty and ultimate beneficial owner (UBO). From the moment a counterparty is entered into the platform, screening begins automatically—giving your team a head start in identifying potential risks before they become issues.

Avallone partners with ComplyAdvantage, a leading provider of banking-grade screening technology, to ensure the highest data quality and accuracy. This integration means you benefit from continuously updated information without any need for manual data transfers between systems. The process is completely automated, removing the risk of delays, errors, or gaps in compliance checks.

Monitoring doesn’t stop at onboarding. All counterparties and UBOs are screened continuously, with changes or alerts flagged in real time, helping you stay on top of evolving risks. For audit or internal review, all screening data can be easily exported into structured reports, providing clear evidence of your compliance efforts. With real-time screening and ongoing monitoring embedded directly into your workflow, you can manage risk proactively, strengthen oversight, and simplify regulatory obligations.

with our users in mind

Why did we develop this Feature?

the challenge

Slow, manual, and inconsistent screening

Screening counterparties and UBOs against sanctions lists, PEP databases, and adverse media is essential for compliance, but many teams rely on manual checks or outdated systems. This creates delays, increases the chance of missing new risks, and requires repeated effort every time a counterparty changes status. Without ongoing monitoring, emerging issues can go unnoticed until it’s too late.

The result

Automated 24/7 screening and monitoring

With Avallone’s KYC Collector, screening starts automatically the moment counterparties and UBOs are entered into the platform. Through our integration with ComplyAdvantage, all data is continuously updated and monitored in real time - without any manual data transfers.

Meaning that:

- You save time with automated, banking-grade screening built in

- You reduce risk by catching updates and red flags immediately

- You stay compliant with continuous monitoring and easy-to-export reports

See the KYC Collector in Action!

%20(1).jpg)

other benefits

Learn more about other KYC Collector Features

Centralized dashbard

Easily view risk, screening, and tasks in progress, with automatic alerts for expiring documents so nothing is missed.

Flexible questionnaires

Need information from a counterparty? Send a ready-made questionnaire in seconds, or quickly build your own with flexible, user-friendly modules.

Risk scoring / assessment

The KYC Collector helps you to apply a standardized, data-driven approach to risk assessment, with built-in, multi-layered risk scoring to create accurate conclusions.

Unlimited collaboration

KYC requires teamwork, so we don’t charge extra for more users. Assign tasks, invite colleagues to upload documents, and keep all parties updated on your KYC work.

HOW AVALLONE SUPPORTS

We're here to help

Whether you’re facing a technical issue or have general KYC enquiry, Avallone’s friendly team of in-house KYC experts are always on hand to guide you.

Knowledge Base

Access product overviews, helpful tips and tricks, and step-by-step instructions written by our expert team. All resources are fully up-to-date and easy to navigate.

Customer Support

Our experienced support team is here to assist with any issues or queries you may have. Drop us a message, or chat with us live, and we’ll always go the extra mile to get you the answers you need.

API Integrations

Our API is open and ready to hook into any of your existing databases. We’re passionate about enabling interconnection between systems – powering efficient workflows and up-to-date real-time KYC information.

TRIED AND TESTED

Customers’ results after 1 year:

Avallone customers see improvement across their KYC processes and response times.

What could your ROI be?

Save the Children loves Avallone's KYC solutions

TRUSTED BY INDUSTRY LEADERS

Our banks have recognized that we’re aiming to be ahead of the curve by adopting innovative KYC solutions. One banking partner even commented that Avallone’s solution is ‘game changing’. Overall, our banking partners are reassured that we’re working with Avallone - a dedicated KYC partner on improving our KYC processes - and proactively sharing risk-related information. I think this has had a direct impact on reducing the number of delayed payments.

— Edward Collis, Treasurer

We really appreciate the insights we see within Avallone’s KYC Collector tool - it has found things that we would never have otherwise uncovered. Our banks also appreciate that we have this extra layer of risk mitigation in place

— Asha Kumari, Deputy Treasurer, Save The Children International

I found the KYC Responder so easy to use and navigate - it’s an excellent one-stop-shop for us. It made getting visibility on data and documents we need to share with banks so simple.”

— Saira Maniar, Senior Treasury Compliance and Crisis Funding Manager, Save The Children International

The Full kyc suite

Powerful on its own, but even better when together

Each product in the Avallone platform is connected to the same underlying KYC database.

While our KYC Collector is an incredible tool on its own, you can unlock game-changing efficiencies and next-level KYC management when it’s used alongside our other products and services.

KYC Responder

Say goodbye to manual handling of incoming KYC requests. Easily save, store and re-use responses to avoid endless duplication.

KYC Hub

One single source of truth for managing and visualizing legal entity structures and documents across your entire organization.

.svg)

Advisory Services

Trust our expert team with +30 years of financial crime prevention and compliance experience to help define processes, develop frameworks and tackle complex KYC challenges.

.svg)

Managed Services

Hands-on support to relieve your KYC / CDD workload. Our experts work alongside your team to provide scalable support where and when you need it most.

STAY UPDATED WITH KYC TRENDS

Related Webinars

KYC in the Era of Global Sanctions

Effective KYC and Sanctions Management for the Future

Crowdfunding for Terrorism Financing

.svg)

.svg)

.png)

.png)

.png)

.png)