KYC Responder FEATURE

As simple as forwarding an email

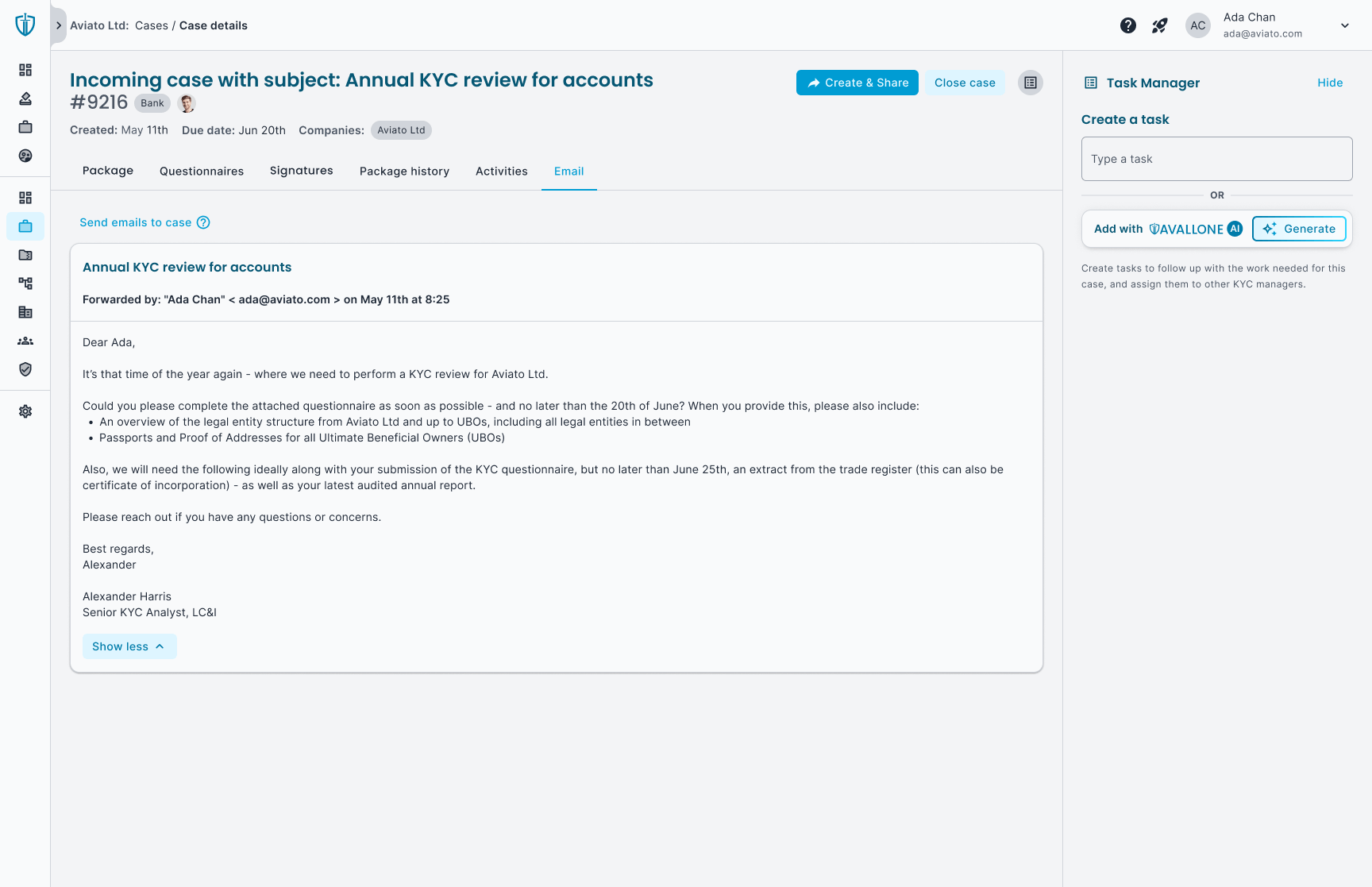

KYC requests rarely arrive in a neat, structured format. Instead, they often come as long emails filled with attachments, vague instructions, and no clear action items. Teams then spend hours combing through text, extracting requirements, and manually organizing documents just to figure out what needs to be done. The result is wasted time, increased frustration, and a higher risk of overlooking critical details.

With Avallone, this messy process is eliminated. All you need to do is forward the request email to the KYC Responder. The system automatically digitizes the questionnaire, extracts the requirements, and organizes the documents into a clear, structured workflow. Tasks are instantly actionable, responses are matched against your existing data library, and the whole process moves from inbox chaos to streamlined compliance.

The feature also makes collaboration effortless. Colleagues can assign tasks, add comments, and track progress - all from within the same platform. It even lets you designate deadlines! By replacing unclear emails and manual coordination with a single, organized view, your team saves valuable time, reduces errors, and responds faster to counterparties, banks, and auditors.

with our users in mind

Why did we develop this Feature?

the challenge

Unstructured KYC requests buried in long emails

KYC requests often arrive as lengthy email threads with attachments and unclear instructions. Teams waste valuable time trying to interpret what’s required, manually extract action items, and organize documents. This lack of structure slows down responses, creates confusion, and increases the chance of missing key requirements.

The result

Frictionless automation and task lists from just one email

With Avallone, you can forward any incoming questionnaire directly to the KYC Responder. The system automatically digitizes the content, prepares answers, and organizes documents, leaving your team free to focus on reviewing and approving.

Meaning that:

- You turn unstructured email requests into clear, actionable tasks instantly

- You save hundreds of hours by eliminating manual sorting and interpretation

- You respond with greater accuracy and consistency, supported by a structured workflow with deadlines, so you finish everything on time

See the KYC Responder in Action!

%20(1).jpg)

other benefits

Learn more about other KYC Responder Features

Smart answer reuse

Take the pain out of repetitive KYC requests. Verified answers are stored, recognized across questionnaires, and auto-filled instantly - saving hours and ensuring consistency every time.

Track each KYC package

Stay in control with full visibility over every KYC submission. See who opened or downloaded your package, when, and how many times - so you’re always informed.

Secure database for all info

Centralize your data and documents in one platform. Uploads go directly into the system, and cross-referencing lets you see relationships across entities and officers.

Unlimited collaboration

KYC requires teamwork, so we don’t charge extra for more users. Assign tasks, invite colleagues to upload documents, and keep all parties updated on your KYC work.

HOW AVALLONE SUPPORTS

We're here to help

Whether you’re facing a technical issue or have general KYC enquiry, Avallone’s friendly team of in-house KYC experts are always on hand to guide you.

Knowledge Base

Access product overviews, helpful tips and tricks, and step-by-step instructions written by our expert team. All resources are fully up-to-date and easy to navigate.

Customer Support

Our experienced support team is here to assist with any issues or queries you may have. Drop us a message, or chat with us live, and we’ll always go the extra mile to get you the answers you need.

API Integrations

Our API is open and ready to hook into any of your existing databases. We’re passionate about enabling interconnection between systems – powering efficient workflows and up-to-date real-time KYC information.

TRIED AND TESTED

Customers’ results after 1 year:

Avallone customers see improvement across their KYC processes and response times.

What could your ROI be?

Novo Holdings loves the Avallone KYC platform

TRUSTED BY INDUSTRY LEADERS

“We went from a totally analog setup where we had no oversight of our KYC work, to a full overview and audit trail available at any time. It’s a very fast system, and so intuitive.

We used to spend 40 minutes on a typical KYC request, whereas now it can take as little as ten minutes. This means that we’ve gained around three working days per month, which equates to more than 300 hours per year!”

— Mia Bøttzauw-Jørgensen, Head of Investment Operations

The Full kyc suite

Powerful on its own, but even better when together

Each product in the Avallone platform is connected to the same underlying KYC database.

While our KYC Responder is an incredible tool on its own, you can unlock game-changing efficiencies and next-level KYC management when it’s used alongside our other products and services.

KYC Collector

Save time collecting and verifying KYC data from counterparties. Streamline screening, compliance and risk scoring in one easy-to-use platform.

KYC Hub

One single source of truth for managing and visualizing legal entity structures and documents across your entire organization.

.svg)

Advisory Services

Trust our expert team with +30 years of financial crime prevention and compliance experience to help define processes, develop frameworks and tackle complex KYC challenges.

.svg)

Managed Services

Hands-on support to relieve your KYC / CDD workload. Our experts work alongside your team to provide scalable support where and when you need it most.

STAY UPDATED WITH KYC TRENDS

Related Webinars

KYC in the Era of Global Sanctions

Effective KYC and Sanctions Management for the Future

Crowdfunding for Terrorism Financing

.svg)

.svg)

.png)

.png)

.png)

.png)